Which way sailor? The rubber meets the road for the indexes.

Breaking down my bullish AND bearish game plan for Monday, hot leaders & more!

Key take-away: ALWAYS trade each stock on its own merit, irrespective of what any other index or stock is doing

Incredibly, the stock market has gone nowhere for nearly three weeks.

Tricky action continues, with explosive breakouts in some names (see tonight’s brand new leaders list) —but not without major volatility around pivot points (see ALAB Friday).

This is creating a challenging and somewhat frustrating environment— if you’ve been overtrading.

One key observation is that high-ADR names are outperforming larger, slower-moving liquid stocks, which is intriguing.

Is money flowing to more speculative assets?

In the Trading Room this our two leading positions, HOOD and CRWV, led the way higher this week, up 8 and 25% on the week, while the rest of the portfolio consolidated.

The big question now is whether we’re seeing a normal, healthy test of the 21-day EMA or a sign of deeper trouble ahead.

I’ll be breaking down:

My bullish and bearish game plan

Setups for Monday - the best names IF we see a bullish response

Indexes and key levels - what to look for

Market breadth & internals (a few warning

Hot themes, leading sectors - what can lead this market?

New refreshed watchlist

Flexibility is my top focus this week.

* Don’t forget to watch the video— it’s where you’ll see me talk in depth about the market & analyse charts, providing a deeper educational insight.

Let’s go!

QQQ

QQQ had a quiet week, continuing its prolonged consolidation.

Price is digesting at resistance, which is ideal before a potential breakout.

On the daily chart, we’re testing the 21-day EMA, a normal move given it hasn’t been tested since the rally began in late April.

I’m staying super flexible, as this could go either way: a break below the 21-day EMA could trigger a larger pullback, while a bounce could propel us toward all-time highs.

I’ll let the market dictate its move and react to price with a plan for both scenarios.

The 65-minute chart: We are below the key moving averages

SPY

SPY pulled back slightly this week, continuing to digest.

Friday brought a clean test of the 21-day EMA, and now it’s time for the index to show its hand. Will it hold and push higher, or break lower?

This test is normal, but the rising count of distribution days is concerning.

My bullish thesis hinges on survival right here— a bounce is critical.

I lean bullish but am ready to pivot instantly if needed.

IWM

IWM chopped around all week, holding at key support.

The moment of truth is here: price must hold above the 21-day EMA, or a larger flush lower is possible.

Prices are ranging between 207.50 and 212, so a breakout in either direction will be the focus point.

ARKK

ARKK had a stellar week, cementing its role as currently a leading ETF.

Three of its top five holdings are clear market leaders, significantly boosting performance.

I’m eyeing a buy on a pullback to a moving average or after extended consolidation. ARKK also serves as a barometer for risk appetite and growth stock performance.

Gold

Gold failed to follow through on last week’s breakout, flagging back to the moving averages.

The move isn’t dead yet, but it must hold support at the 21-day EMA and break out of this flag pattern. Otherwise, a deeper pullback to test the 50-day is possible.

Bitcoin (long)

Bitcoin confirmed weakness with a downside break below its recent range and a clear move below the 50-day moving average.

We exited our position today for a controlled loss. The best trades work quickly, pushing off their entry points.

Bitcoin’s persistent volatility and lower-high structure grew ominous, and today’s price action confirmed the downside.

It may find support at the 10-week moving average, where a pullback buy could be considered, but only after consolidation.

USD

The dollar had an inside week, finding support as it reclaimed the 10-day EMA. It still needs to clear the 21-day EMA to confirm a potential bottoming process.

TNX

The 10-year yield also had an inside week, looking poised to break below the 50-day moving average after failing to clear the descending trendline.

The 200-day moving average below could provide support.

Our market indicator

Remains on a YELLOW signal.

Qullamaggie indicator

Our Qullamaggie indicator remains RISK OFF.

This is the third consecutive day on a risk-off signal. Ideally, a bounce off the 21-day EMA will propel us toward a test of the highs, but I’ll tread cautiously while these conditions persist.

SKFD

A slight pullback keeps us below neutral readings. Remember, extremes are where the value lies in these tools!

We’re far from FOMO and could see lower readings if the market breaks down next week. Staying flexible.

NCFD

A slight uptick today, but we’re still in no-man’s-land with room for a move in either direction.

With the indexes at pivotal points, it’s best to wait for the market to confirm its next move.

NASI

Flips to a SELL signal.

This is going to remain a headwind for the market as it will be tougher to make money with this going against us.

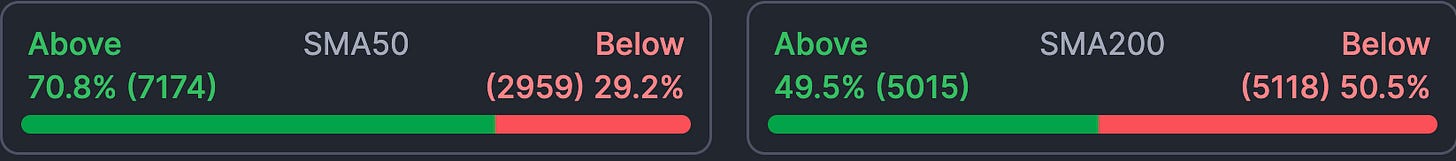

FINVIZ market snapshot

1 week performance heat map

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, nightly video and more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.