Struggling? Ditch the higher flyers, focus on the THIS

Indexes break out, NASI hooks up - Go time.

Key takeaway: Focus on the big liquid leaders and avoid the brutal swings.

Today delivered index breakouts and nice portfolio gains, validating our bullish game plan.

A great day saw our portfolio push higher and our cushion build. Later I’ll mention the one key mistake to AVOID missing huge winners.

HOOD was a monster for us, as the indices broke out from key pivots, setting the stage for sustained upward momentum.

We also saw some signs of trouble— many smaller caps saw ugly reversals, as did many of the pre market gappers like HIMS, CEG & others.

In the Trading Room, we used some strength in CVNA to trim our first partial, and also added PLTR later in the day.

Tomorrow we have the jobs report pre-market— non event, or will we see a response?

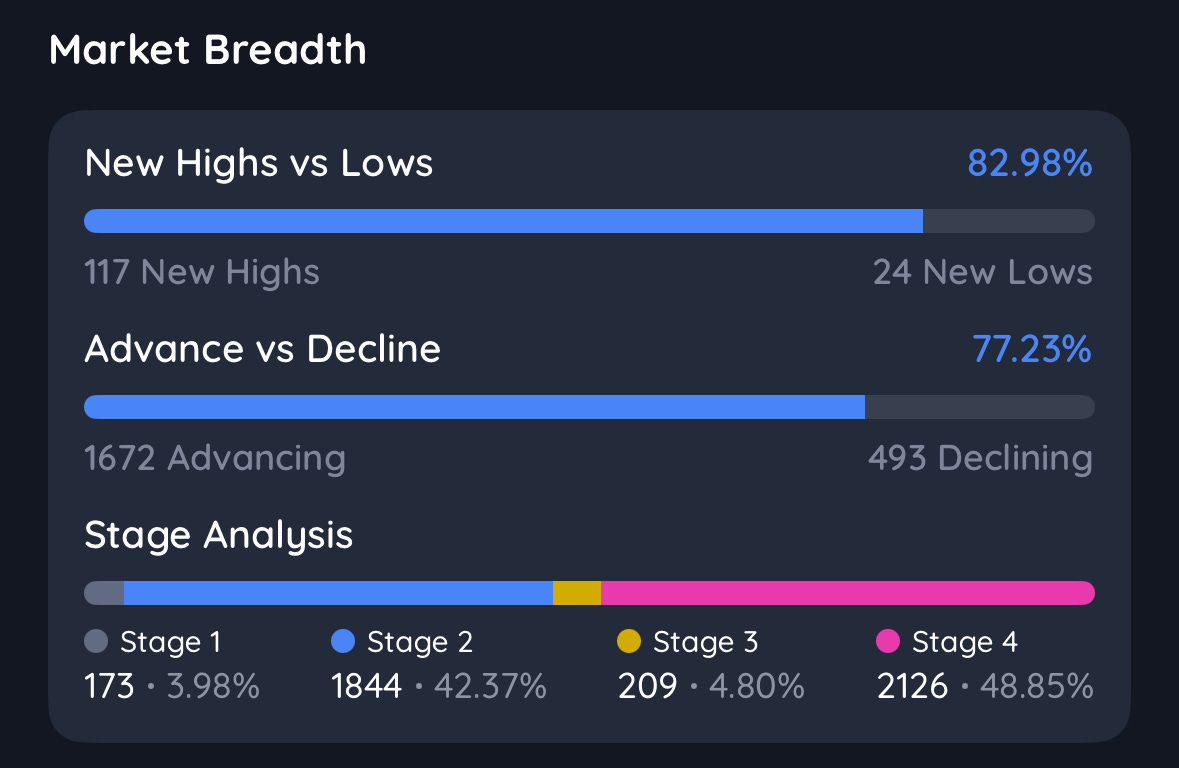

Net highs expand, our indicator flips green…lots to like right now.

Let’s get into it!

QQQ

The QQQ rallied after a quiet open, closing near the day’s high.

It’s grappling a breakout above the 527 pivot. I’m watching for a convincing push from this level toward the all-time high near 540.

The Magnificent Seven stocks are performing strongly, providing a powerful tailwind for the QQQ. The setup looks primed for higher prices— now we wait for market confirmation.

SPY

The SPY broke out of the descending trendline highlighted in last night’s newsletter, making it actionable for a trade via SPXL.

This breakout from consolidation is a healthy step forward.

Resistance looms above, but clearing 600 opens a direct path to prior all-time highs.

IWM

The IWM executed a textbook breakout from the descending trendline discussed last night. Support held at the 21 EMA for days, and today’s breakout was stellar.

The next test is breaking above the May highs and then we can charge toward the 200-day moving average.

Gold

Gold pulled back slightly, retesting yesterday’s breakout trendline before a modest bounce.

Though down on the day, it held most of yesterday’s breakout candle. The next challenge is surpassing the May 7 high.

Bitcoin (long)

Bitcoin looks promising as it turns upward, reclaiming the 21 EMA and testing the 10 EMA.

Horizontal support between 102,000 and 103,000 guided our decision to hold despite a brief dip below the 21 EMA—a reminder that trading is often an art, not a science.

A sustained trendline break and a decisive move above the 10 EMA are key.

USD

The dollar showed early weakness before rallying near horizontal support referenced yesterday. Let’s see if it holds these lows.

TNX

The 10-year yield continues to consolidate at the 21 EMA support.

Watching for a bounce or further pullback. Yields remain calm, supporting the equity rally.

Our market indicator

Flips back on to a GREEN signal.

Great to see us back in RISK ON mode, as we got the NASI hooking back up.

The best periods to trade are on yellow and green backgrounds!

Qullamaggie indicator

Our Qullamaggie indicator remains RISK ON.

A strong market push lifted our indicator, as it rides moving averages higher in risk-on mode.

The QQQ breakout attempt should help keep this indicator firmly green as the moving averages remain in a stacked uptrend.

via Deepvue

SKFD

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.