Markets reverse - 10ema bounce incoming, or start of a pullback?

Breaking down today's action. Trade ideas, portfolio review, Crypto, Market Timing indicator update

After showing strength early in the day, the markets rolled over closing at their lows.

Let’s breakdown a tricky day where many names pushed higher before reversing.

Despite this volatile day - there are some strong leaders setting up that we’ll analyze below. Let’s unpack these ideas, tomorrow’s gameplan, cryptocurrencies and more.

Below are instructions to access the Telegram group chat (for members only), where I share trade management updates and other key market/position observations.

Tonight’s newsletter

Index review

Market timing indicator

Watchlist/trade ideas

Portfolio review

1. Indexes update

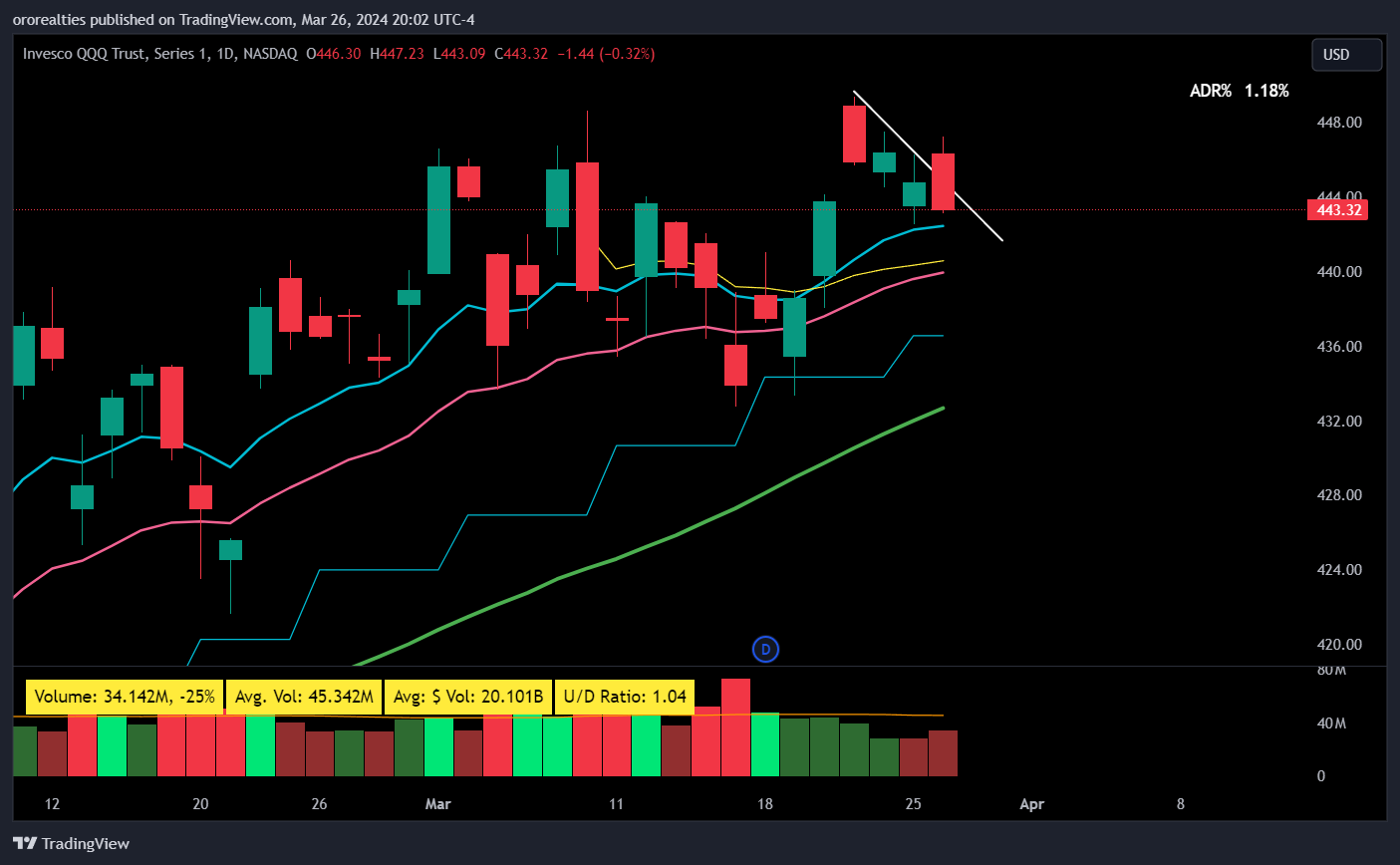

QQQ - Attempted to push out of this mini-flag before squatting and breaking lower. Bulls want to see this 10ema hold.

IWM - This index opened up strong before rolling over. Sitting now on 10ema support, let’s see if it can hold this spot.

SPY - Continues to flag into the 10ema area. Very curious to see how we respond to the moving average support area. This index also opened higher before rolling over.

2. Trade ideas-Watchlist-System Signal

We have 5 ideas for tomorrow’s trading day.

Crypto continues to look constructive and we are patiently waiting for fresh setups to emerge in the space. Despite choppy market conditions, many leaders continue to show powerful strength and well setup up.

TRADE IDEAS - Note, all entries are marked on the chart (green line) and stop losses are low of day OR prior day’s low, unless written otherwise. Please feel free to use discretion and use whatever stop risk level you are comfortable with. Most of the time, I use the low of day (0-1.5% stops typically).

LLY

Setup: Trendline breakout and Inside day

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.