Letting winners ride (HOOD +94%) and waiting patiently for digestion

Thinking risk/reward first, but there's 2 monster stocks that could break out tomorrow

Key takeaway: Ride your winners. They can trend longer than you think.

We started the trading week in a short-term extended position, and once again, the market pushed higher.

It was great action across the board, with LOTS of power on display.

Leaders making new highs, names pushing off moving averages…

You’ve all heard it: “LET YOUR WINNERS RIDE”… well, here’s why:

In the Trading Room, we locked in another trim in HOOD, which now sits +94% from our entry!

Imagine selling everything just because the market is a bit extended? Trim where needed, but ride trends.

Trusting moving averages allows us to ride trends and remove emotion from the holding process, which is what leads to big winners. Discipline is critical here, especially when indexes are extended AND your best names have already broken out of their pivot points.

Chasing laggard setups here carries elevated risk.

In the Trading Room, our focus was on discipline to let our newer positions build cushion, and that’s exactly what we got

Tonight, I’ll look at:

WHY I trimmed more HOOD

Indexes & key levels to watch

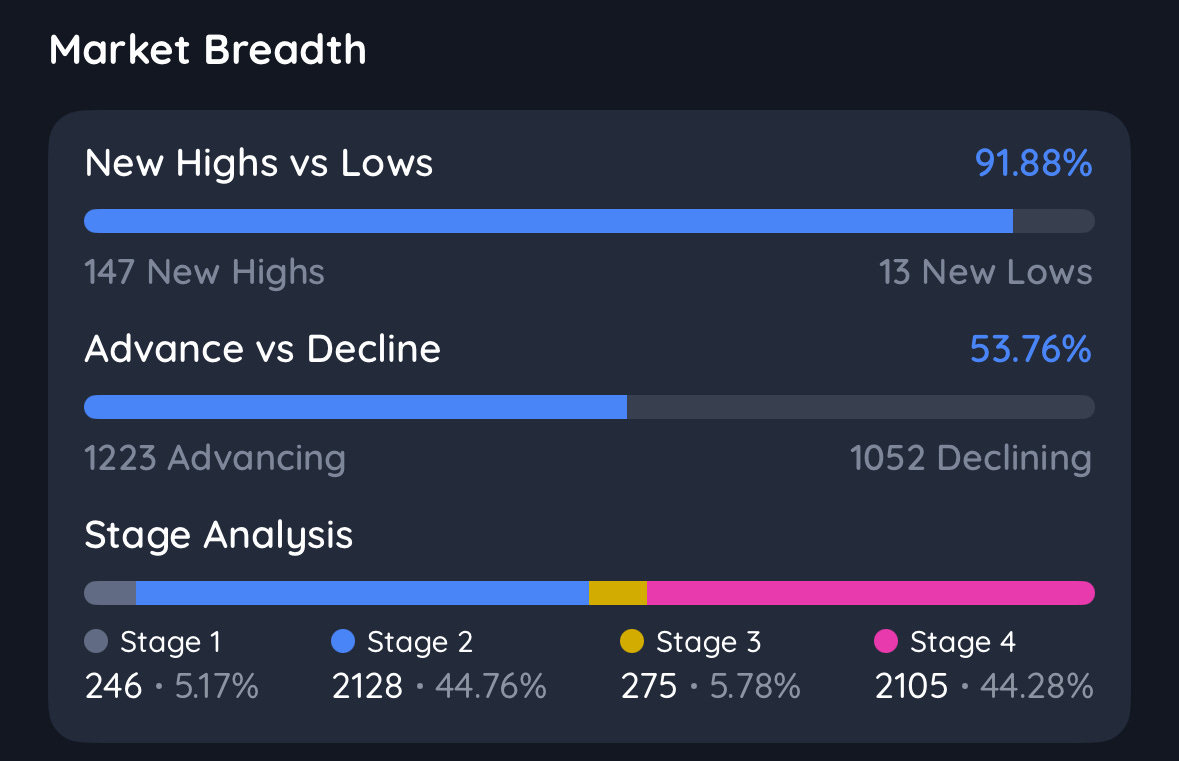

Market indicators/Market Breadth update

Setups to watch for anyone underinvested - the best LOW risk ideas

Hot themes & leading sectors

My list of top stocks that COULD be close to setting entries

Let’s dive in!

QQQ

QQQ started the week with steady price action as it continues to stretch away from the moving averages.

History shows the best risk/reward opportunities come after market digestion or pullbacks, so it’s crucial not to chase the market too aggressively here.

You can feel the difference when trading with the market’s tailwind versus fighting the trend.

HOOD is showing us there's real benefit in letting your positions work as the market tires and gets extended.

SPY

Another day, another all-time high for SPY. That said, based on today’s close, the index looks a bit tired and may need some short-term consolidation.

I remain optimistic as long as we trade above rising moving averages, but I’m fully aware of how extended this market is. A shakeout could occur at any moment.

A sideways consolidation would be the ideal scenario.

IWM

IWM continues to battle its 200-day moving average. If it can reclaim and hold above this level, a clean move toward 230—the next major resistance level—could follow.

As with any stock or setup, always build a thesis but let the market confirm the move instead of trying to front-run a breakout.

ARKK

Last week, ARKK broke out of clean resistance.

We may now see it form another consolidation. I’m closely watching this ETF for a pullback to the moving averages or a sideways pivot that could offer an entry.

The left side of the cup is around 68.53—an area where we might see price retest. Watching closely.

Gold

Gold remains below the 50-day moving average but showed some strength today—perhaps buyers are stepping up at this key level.

I don’t see a setup, so I’ll remain an observer here.

Bitcoin (long)

Bitcoin is forming a constructive base just below a horizontal trendline.

It's holding above the moving averages, which is a key ingredient in our process, and the chart is behaving well.

The next step is to take out the trendline and then the June highs, which, if broken, could open the door to retesting all-time highs. One day at a time.

Long from 106,618

USD

The dollar continues to grind lower, slipping through horizontal support. There are still no signs of bottoming in the price action.

TNX

The 10-year yield is making new lows in its downtrend and is now well below the 200-day moving average.

It’s approaching a demand zone from May, so we’ll watch for supportive action there.

Our market indicator

Remains on a GREEN signal.

We are touching the upper Keltner band here….something to be very weary of. Nice to see net highs picking up here.

Quallmaggie indicator

Our Qullamaggie indicator flips quickly back to RISK ON.

We continue to trend positively with a clear risk-on signal, as moving averages remain aligned and slope upward.

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, portfolio, the full video version of my newsletter, & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.