Leaders launch, but high flyers get hit. Semis top dogs?

4 sectors really fasten their grip on leadership.

Key takeaway: Gap ups are gifts…but always approach them with CAUTION

Today's key test came in the form of the all-time high resistance — and if we would break out, or see stalling action.

We saw the latter, as indexes consolidated and momentum stocks pulled back hard.

One positive on the day was the immense strength in the crypto space, semiconductors, and cybersecurity stocks, while most of my broader watchlist pulled back.

This type of mixed action is enough to keep me a little more tentative here; let’s wait for a push higher to confirm.

The key now is to see the indexes take out today's high going forward, which would signal a return of bullish momentum.

Portfolio and watchlist feedback is critical in helping you assess how aggressively to approach the market—and tonight I'll discuss a few positives and negatives I’m currently seeing following today’s session.

In the Trading Room, we added cybersecurity leader CRWD which pushed out to make new highs!

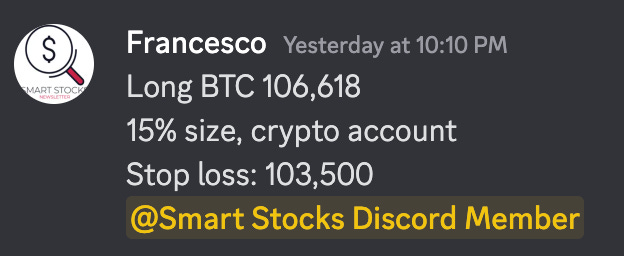

Last night, we also added back a position in Bitcoin:

Tonight, I’ll look at:

The new leading sectors and stocks that dominated today

Stocks that came under pressure

Setups to watch for tomorrow

Our Bitcoin entry

Understanding psychology at major pivot levels

Market Breadth & indicators

Let’s dive in!

QQQ

QQQ made a new all-time high before squatting.

Although I would've preferred to see a gap-and-go move today, I'm not too surprised by the action.

When price approaches a significant pivot point, you often see volatility around that area — and this is a critically important pivot.

Perhaps we see this index digest for a few days or come down to test the rising 10 EMA. Right now, we remain above the moving averages, which is the most important factor.

We're cruising above rising averages and just came off a near two-week digestion— I’ll stay optimistic until price loses the short-term averages.

SPY

SPY also gapped up but has not yet made a new all-time high.

Despite the pullback from a strong opening print, we didn’t see this index fall apart. I still believe what we're seeing is some orderly digestion around a volatile area.

One thing to note is that today’s gap up was modest, and we did not violate prior day lows — so I don't want to become too negative on the market here.

The trend remains up, and I’ll continue to stay as objective as possible until price proves otherwise.

IWM

Last night I mentioned that the 200-day moving average resistance just overhead would be critical for IWM.

Today, we saw price fail to make a run at that level. The rejection brought price back down to the 212 level, which roughly coincides with the 10 EMA.

We're still above key moving averages, so a breakout is still possible — but for now, small caps are showing some weakness.

ARKK

ARKK has had a phenomenal run since the breakout from the 58.60 pivot, and now we’re seeing a bearish engulfing candle, which could lead to a pause or pullback in the ETF.

Neither would be surprising after more than two weeks of consistent gains.

How this ETF consolidates from here will be very important, and I’ll definitely be watching for a potential pullback setup.

Gold

Gold finds itself sitting right on the 50-day moving average and inside yesterday’s candle.

It has been chopping sideways since April, but if we zoom out, we can see a pattern of higher lows.

We’re sitting in a high-risk, high-reward zone in gold that could provide a low-risk entry point. I’ll be watching closely — failure to hold here could send price flushing below the key 50-day support.

Bitcoin (long)

Bitcoin is showing improved price action, and we used strength from the wedge pop to open a new position.

My trigger was a breakout back above the moving averages, following what appears to be a double bottom shakeout.

I like that price dipped below the 10-week moving average but held and reclaimed it. If the market follows through on a breakout, I believe bitcoin will participate.

-Entries always live in The Trading Room

Long from 106,618

USD

The dollar is once again showing weakness and looks increasingly likely to flush the lows of its range. It’s hanging on by a thread here.

TNX

The 10-year yield continues to look weak as it attempts to hold the 200-day moving average.

Our market indicator

Remains on a YELLOW signal.

We lost the NASI again today.

* Indicator is currently being updated by coder

Quallmaggie indicator

Our Qullamaggie indicator flips quickly back to RISK ON.

Despite the reversal today, price remains above the 10 EMA, which keeps us on a green risk-on signal.

It’s easy to be influenced by daily fluctuations, but the primary trend remains up, and we’ve just broken out of a healthy digestion.

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, portfolio, the full video version of my newsletter, & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.