Inside Day Setups Proliferate for Monday – Is The Market’s Next Big Move Loading?

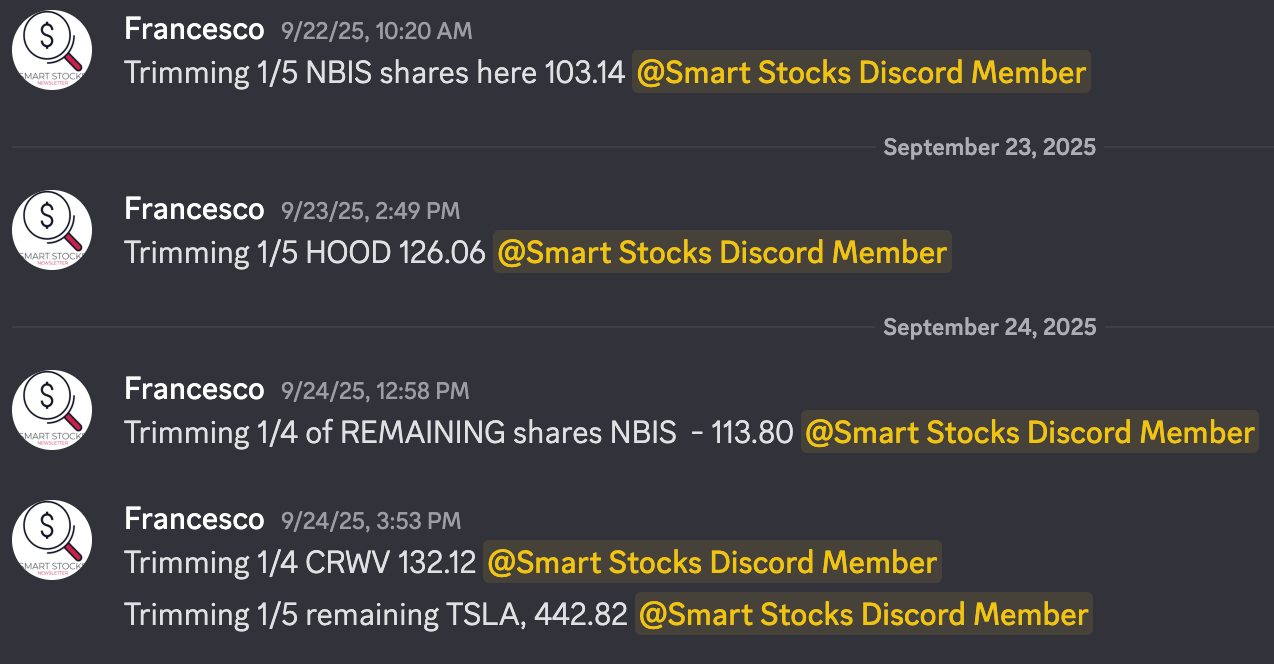

The power of trimming, and why I'm optimistic: With one foot out the door.

Key take-away: When the bullets start flying, you need a process to lean on— or else you’re going to fail.

So, is the pullback over?

It may just be.

After a ROARING start to the week, selling pressure finally hit this market — but are there subtle hints that the selling could be running out of steam?

Many stocks have pulled back sharply over the past couple of sessions, and with lots of euphoria, FOMO and excess eroded, conditions could be lining up for the potential of a bounce to kick off next week.

But I’m still cautious — many leaders got smacked.

In The Trading Room, our offensive trims into strength earlier in the week paid off big, making it much easier to sit through this pullback with confidence.

Even better, the vast majority of our watchlist names are still holding above key technical levels — a crucial sign of ‘a trend that’s holding up’.

Here’s the truth: if you’re not willing to sit through pullbacks, you’ll never be in the running to catch the big moves.

Pullbacks often set up the best opportunities, tilting the risk/reward heavily in our favour.

I’ve got a number of fresh ideas lined up, and if we get upside follow-through next week, some very powerful themes could be ready to explode higher.

TRADE OF THE DAY: A setup for you to watch Monday.

MDB: Pullback Buy

A monster earnings gap, that has now spent a couple of weeks digesting, managing to hold the gap very nicely. I like this test of the 21EMA area.

ALL other ideas, you’ll find below in the Actionable Ideas section.

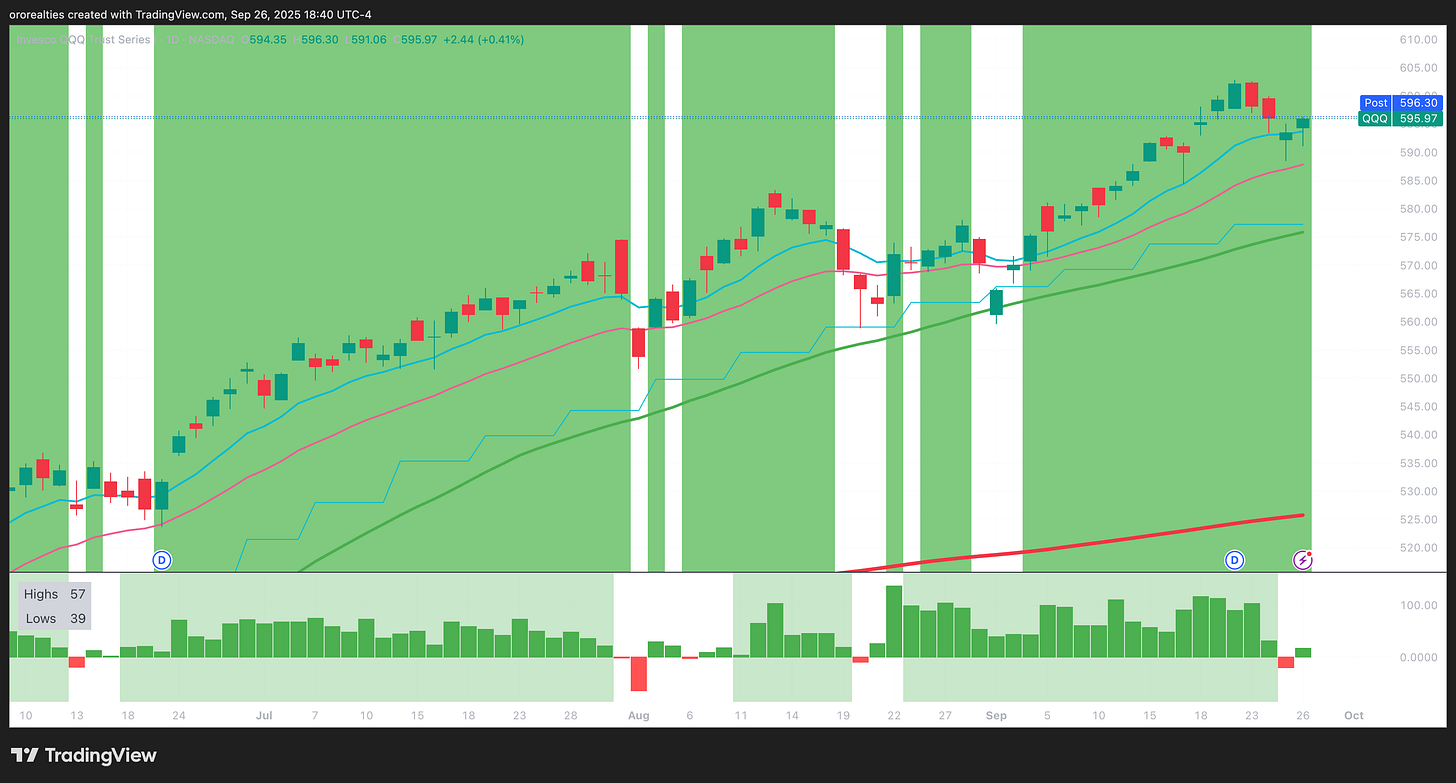

QQQ

It was a pretty wild week in the QQQ, starting things off at all-time highs and then rapidly shaking out, almost tagging the 21 EMA.

Whilst sitting through the pullback is unpleasant and nobody likes to see their positions draw down, we have to remind ourselves that some of the best opportunities come from these events.

With some of the euphoria being drained out, prices have succumbed to gravity and started to normalize somewhat.

I like that we were able to quickly snap back above the 10 EMA with buyers stepping up on Thursday and Friday, evidenced by the long tails on each candle. I think this is a great little building block for next week, but let’s await price confirmation.

The 65-minute chart:

SPY

SPY also had a decent shakeout, which saw price come down and test the 21 EMA for the first time since the beginning of the month.

We cannot complain with the way price was supported at this level, bouncing very nicely on Thursday. On Friday we saw prices recover the 10 EMA, which is our most important risk-on/risk-off barometer.

This trend remains strong, resilient, and up — so it’s nice to see the rapid snapback.

The prior high is going to be the next level for us to keep an eye on, and maybe we see a small base built as prices chop around for a while.

IWM (long via TNA)

IWM made a new all-time high on Tuesday but reversed course quite quickly, closing on the lows of the day, which led to a couple of days of selling.

After testing and finding support at the 21 EMA for the first time since just before the Jackson Hole event, we saw a really nice response to this moving average support level.

Price was able to slingshot higher and hold this key moving average. We are now narrowly back above the 10 EMA, which keeps this trend in gear, but we want to see some more follow-through.

ARKK

ARKK had a very wild week, from 52-week highs and crashing all the way down to the 21 EMA, where it did find some nice support.

I’m looking to see if price will settle down a little bit, because volatility ramped up in a major way this week, which makes it very difficult for us to get positioned without tight, low-risk entry points.

I will be patient and pick a spot carefully, but I do see a potentially important trendline level that could help build a setup in the coming days.

Gold

Another very strong week in gold as it continues to trade like an AI stock, ramping higher in this incredibly strong uptrend.

We’ve been saying the same thing for a number of days, as there is no current setup in this chart and we’re waiting patiently for some sort of base or digestion to develop.

Strength continues, and patience to wait for a clean setup is job number one.

Bitcoin

Is Bitcoin trying to make a stand at the previous support level? It sure looks like it right now.

Whilst I’m not focused on an entry here below all declining moving averages, I will be watching to see if prices can stabilize around this level, with some pretty decent support coming in at 107,500.

I’ll be watching this chart closely to see how it develops in the coming days and weeks ahead.

ETH (long):

Ethereum had an ugly week, but some decent support buying came in on Friday. If we actually zoom out to the weekly timeframe, we will see that a classic support and resistance flip is potentially playing out here.

What I am referring to, very simply, is the prior highs of March last year and December last year — previous resistance, now possibly acting as support.

This is a very normal phenomenon in technical analysis. Let’s see if it can work its way back towards the moving averages and set up a potential wedge-type slingshot through these key levels.

QQQE

QQQE had a very nice week, recovering strongly from Thursday’s violent shakeout. It’s encouraging to see these levels hold up despite the market coming under some decent pressure. This equal-weight index looks pretty strong.

RSP

RSP had a bit of a tough week and almost threatened to lose the 50-day moving average on Thursday, before recovering very nicely on Friday to close the week above the moving averages.

Price has not closed below the 50-day moving average since the April lows, so whenever that occurs, we are likely to get a decent warning signal.

TRADING TIP OF THE DAY:

Decide your profit taking approach BEFORE you enter the trade.

Our market indicator

The shakeout hit, but things continue to look constructive as we hold a YELLOW signal.

We need to build on this next week!

Qullamaggie indicator

Our Qullamaggie indicator remains RISK ON.

After experiencing a pretty nice shakeout this week, this indicator remains on a risk-on signal and the uptrend remains intact.

This market remains incredibly resilient as the dips continue to be bought and moving averages keep holding. The bears had every chance to crack it this week and were unable to do so.

MMTW - Stocks above the 20-day:

A nice bounce from yesterday’s drop, with prices heading back up towards the 200-day.

USD

The dollar is back above all moving averages. The chart is wildly choppy, with the horizontal 50-day depending this ‘trendless’ environment.

Looking for the next level?

Get daily market and hot theme review, actionable trade ideas, market breadth updates, portfolio review & my comprehensive nightly video & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.