Game-plan: Indexes look PRIMED! New Semi enters PF

Portfolio rocks, lead higher by HOOD, GEV & META.

Key takeaway: Sometimes the best stock…is the one you already own

Super day today, and now comes the $1 million question — are we going to see the indexes break out to new all-time highs tomorrow and push?

Some powerful moves today, excellent portfolio traction, and really encouraging signs.

HOOD led the charge in the portfolio, making another explosive move to a 52-week high, closing in on its all-time high from the IPO. New highs for GEV too.

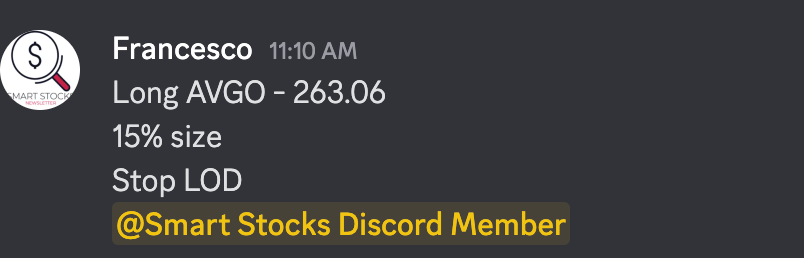

In the Trading Room, we finally added a Semi name.

Leaders continue to perform well, and setups are showing follow-through.

If the QQQ and SPY can break out to new all-time highs, we could be in for a strong move following this multi-week digestion.

Exciting things are happening as we monitor some nice traction, bitcoin turning back up, and indexes hovering near all-time highs.

Let’s dive into a very bullish-focused newsletter— but as always, FOLLOW PRICE, be ready for anything!

Tonight, I’ll look at:

The index approach and TQQQ trade idea

Our new Semiconductor name

More trade setups for tomorrow

Mindset behind sitting in winners

Market breadth update, market indicator, internals

Hot themes, Portfolio review

Let’s dive in!

QQQ

QQQ had a fantastic breakout from the flag pattern discussed in last night’s newsletter and is within a hair of testing its all-time high.

If we zoom out to the weekly chart, we can see a very long cup base with multi-week digestion. Anything is possible, but a breakout from here could certainly pave the way for a strong move.

Of course, I must reiterate — we have not yet seen the breakout occur, so do not assume anything. There’s always a chance the market rejects this pivot and pulls back, which is why it’s critical to be prepared for all scenarios.

I remain bullish based on the healthy action among leadership.

SPY

SPY followed suit and broke out beautifully from the descending trendline setup off 21 EMA support.

For now, the market seems to have chosen its direction, and the next stop is a test of the all-time high at 614.

Prior to today, this index had mostly gone sideways for about a month, so perhaps enough buying pressure has built up to fuel a breakout attempt.

The all-time high pivot will be very obvious, but it’s the key level that will determine what happens next in this trend.

IWM

IWM broke decisively through the range discussed last night and is now on track for another test of the 200-day moving average.

This is a crucial level because it’s exactly where the rally failed last time and sellers stepped in.

The 200-day moving average and the technical high at 216 will be the key pivots to watch on IWM.

ARKK

ARKK continues to be a monster as it breaks out to new 52-week highs and extends this powerful trend.

We’re seeing a major character change in this ETF, and I believe it could continue to lead from here.

There’s no need for FOMO — just zoom out to the weekly chart and see how much upside potential remains. Stay disciplined and wait for a proper entry point.

Gold

Gold’s structural weakness persisted today as we saw 21 EMA support breached, and price is now testing the 50-day average.

I’m watching closely to see whether this level holds or if a further collapse is in store.

Bitcoin

Bitcoin is back on my radar, and I’m watching for an entry here.

My next area of interest is around 106,500, which would confirm a reclaim of the moving averages and the most recent high.

After a quick shakeout under the 10-week moving average, the rapid recovery is impressive.

Historically, many of the best-performing stocks of all time test the 10-week before launching another leg higher — this technical behaviour is very much on my radar.

USD

The dollar saw follow-through downside rejection today as it tests the lows of the range.

Will we see a clean break here or support step in again? The trend remains firmly lower.

TNX

The 10-year yield continues to roll over, which is certainly giving equities a boost.

We’re now seeing price drop below the 200-day moving average, opening the door to a larger pullback in yields.

Our market indicator

Flips to a GREEN signal (software glitch shows yellow)

Great to see us with net highs again, cruising above the 10EMA, and the NASI hooked back up!

Quallmaggie indicator

Our Qullamaggie indicator flips quickly back to RISK ON.

We’re seeing excellent price action as we build on yesterday’s reclaim of the green risk-on signal after multi-day digestion.

If markets break to new all-time highs, we could be in for a very favourable move.

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, portfolio, the full video version of my newsletter, & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.