Key takeaway: Sometimes, sitting tight and doing nothing is the only thing to do.

After a monstrous trend day, markets cooled off and took a breather. Normal!

The QQQ paused at resistance, reinforcing the significance of this pivot.

We saw strong gains in GEV and CVNA, which was great as their cushions expanded. The rest of the portfolio digested nicely.

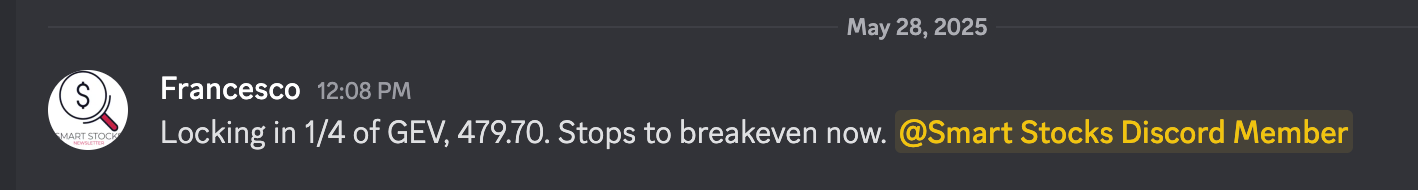

I used the strength of GEV to book our first 1/4 partial at a very nice multiple of our risk:

* All trades are shared in real-time in The Trading Room

I am feeling pretty excited about tomorrow. If QQQ can push today’s high, we could be off to the races.

Tonight, I’ll lay out of my gameplan to get more exposure on tomorrow, trade setups I am watching, an updated leaders list, my full analysis & more!

Let’s get into it!

QQQ

The QQQ had a healthy day of rest, testing the 523 resistance area early before retreating from this pivot.

This confirms the level’s importance, and we’ll need a decisive breakout above it to sustain upside momentum.

I love when the market draws a clear line in the sand.

Rest after yesterday’s big move is healthy, and a handle forming at these levels would be constructive. A breakout above today’s high would be very bullish.

SPY

The SPY had a quiet day, holding most of yesterday’s gains. The next level to clear is 595, which could open the door to the prior all-time high resistance area.

The index looks healthy, with prices holding above the moving averages.

IWM

The IWM pulled back slightly but remains comfortably above its moving averages. The action at the key 210 pivot will determine if the uptrend resumes.

Continued small-cap participation is essential for broadening market health.

Gold

Gold was quiet, sitting near its moving averages.

I’m not seeing a clean setup yet, but I’ll monitor whether it flushes below the 50-day moving average in the coming days or weeks.

Bitcoin (long)

Bitcoin continues to consolidate healthily around the prior all-time high pivot. Choppy price action at such levels is normal.

Bitcoin has been trending higher for a while, so a longer digestion wouldn’t be surprising.

I’m using the 21 EMA to manage this trade and will stay long as long as we hold above it. Stocks, like athletes, need rest after big moves to regenerate energy.

USD

The dollar snapped back today after testing a support zone yesterday. The next step is to see if it can reclaim its moving averages.

TNX

The 10-year yield posted an inside day but remains at support. Rising yields are a key market threat, so I’d welcome a sharper pullback here.

Our market indicator

Flips to a YELLOW signal.

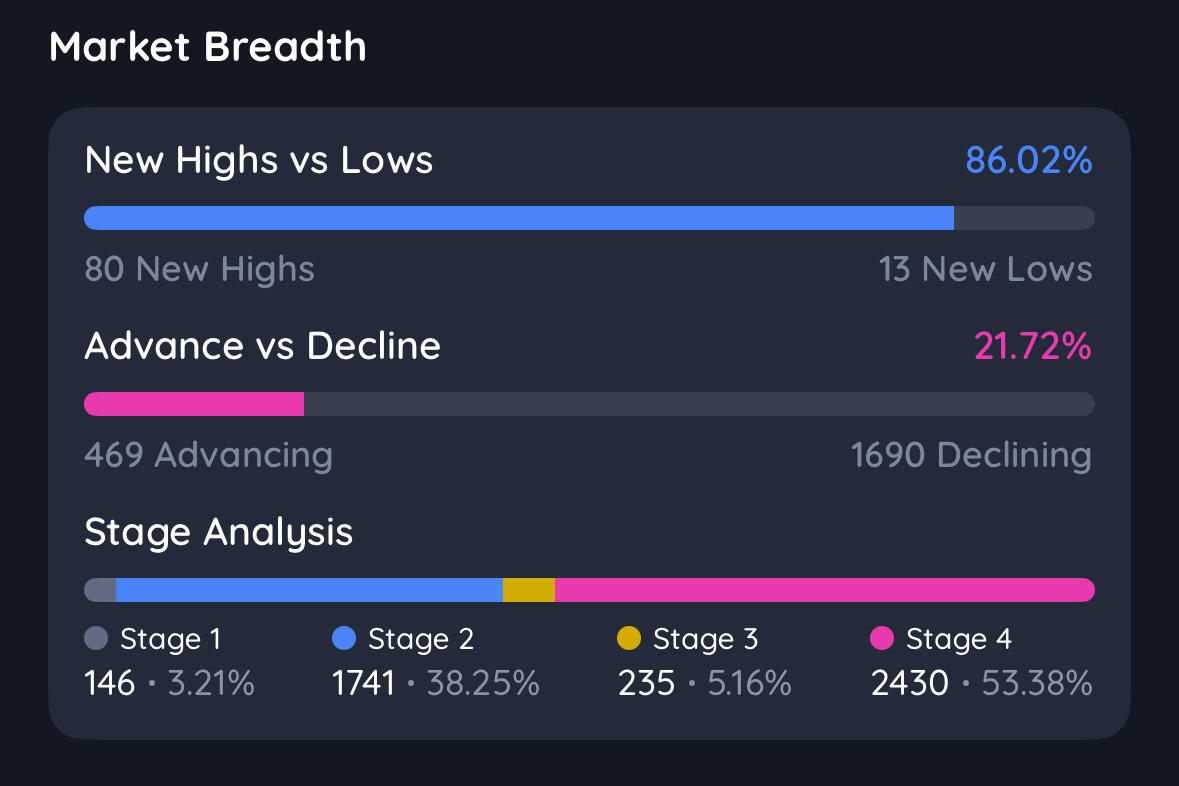

We are holding nicely above the rising short-term moving averages. Let the trend work. Net highs emerged despite a pullback day in the market— nice to see that.

Qullamaggie indicator

Our Qullamaggie indicator remains RISK ON.

The risk-on signal remains intact as price holds above the 10 EMA. Both short-term moving averages used for this indicator are now trending firmly higher.

Onward and upward!

via Deepvue

SKFD

A modest pullback today, and we’re still quite bullish/neutral here. Lots of room for higher if the market rallies from here.

NCFD

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.