Bulls get trapped: Why I avoid buying gap-ups, and chose to take profits

Moving averages keep us safe once more. Bears maul again.

Premarket action was hot, setting up an explosive gap higher.

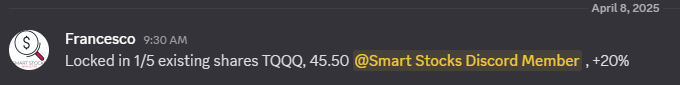

Instead of buying and getting sucked into the gap up, we used it to sell offensively:

Knowing the moving average and gap resistance that lay above, we used the gap up open to book more profit into strength, right at the opening bell:

TQQQ closed nearly 15% lower!

Trade shared in The Live Trading Room:

I frequently highlight the dangers of chasing a gap up, especially in a bear market rally. Our discipline kept us from initiating new positions, sparing us from a brutal market reversal.

Tonight I will go over how I handle gaps in the market and dangers to spot and consider before placing a trade.

Today’s bull trap was vicious and inflicted further damage on this already beaten-down market.

Patience is so important here, with tariff headlines running rampant once more and CPI/PPI on deck.

Let’s break down another wild day and our trade management of TQQQ.

QQQ

QQQ posted a massive gap up, and we seized the opportunity to trim more TQQQ into strength, just shy of the day's high.

Today, price narrowly breached the 5-day SMA before stalling, aligning with yesterday's high. This underscores why I emphasize "looking left" to map out potential resistance on a chart before trading.

We've now established a clear pivot around 443 and change. This rally is stalled until that high is taken out. Bulls need a wedge breakout through the moving averages to trigger a buy signal.

SPY

SPY gapped up into the declining 5-day SMA before a sharp rollover.

Price action across the indexes today feels ominous, with all gaps filled so far. I suspect this could lead to a test of the lows, though we’ll remain adaptable.

526.24 is a critical upside target for bulls.

IWM

IWM was the weakest index today, posting a heavy sell-off after tagging the declining SMA and turning lower.

We’re seeing brutal chop—typical in a news-driven market trading below declining averages.

Tempering expectations and maintaining strict discipline by avoiding overtrading is crucial.

Gold

Gold is clinging to its rising 50-day SMA after a blowoff top reversal.

Volume has spiked on this downside move. If it tightens up and holds above support, a position might be viable—though I’d prefer more basing action first.

Bitcoin

Bitcoin is testing lower, rejecting the declining short-term moving averages overhead.

This market is a masterclass in tracking price relative to moving averages.

Its recent relative strength seems to have been on borrowed time, now buckling under broader market weakness.

USD

The USD rejected the declining 10-day EMA today. We’ll watch if it’s forming a higher low or a bear flag.

TNX

The 10-year yield built on yesterday’s reversal, pushing up to clear the 200-day SMA.

Our market indicator

Remains on a RED signal.

Our market indicator still shows no signs of positivity amid this prolonged risk-off period.

We’re back above the lower band count, and the put-to-call ratio has eased slightly. However, market breadth remains weak, and today’s reversal hasn’t helped.

Qullamaggie indicator

Our Qullamaggie indicator remains RISK OFF.

Today’s weak reversal sees no improvement in the slope of the moving averages.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.