Breakout mode: traction heats up, pressing the gas, BUT: be mindful of THIS

Traction in the port, more setups and fresh all-time highs! Let's go!

Key takeaway: Sit in your winners. Sometimes the best stock is one you already own.

Markets delivered the bullish response we were hoping for, with momentum snapping back in force.

The QQQ surged to fresh all-time highs, powering decisively above yesterday’s high.

Momentum names that came under pressure yesterday roared back to life, lighting up the tape.

Our portfolio responded beautifully, with leaders charging ahead and several positions gaining serious traction.

All eyes now turn to tomorrow’s premarket PCE data — a potential market mover that could add even more fuel to the fire.

Tonight, I’ll look at:

My elite PULLBACK BUY FOCUS list - the best name I am stalking

Actionable trades for tomorrow

Index review and levels - QQQ extended?

Market breadth

Hot themes, performance of the day overview

Portfolio review

VIDEO!

Let’s dive in!

QQQ

Yesterday we spoke about the QQQ price action being constructive, though we would’ve liked to have seen more of a push.

We also noted that while price remains above rising moving averages, it's doing no wrong—and we should expect some noise at such a significant level.

Well, today we got a fantastic breakaway move from the QQQ, pushing into highs with real power.

This has been a great launch off the 21 EMA, but let’s be mindful of potential short-term extension.

I’m likely leaning more toward letting winners run rather than chasing too much fresh exposure here.

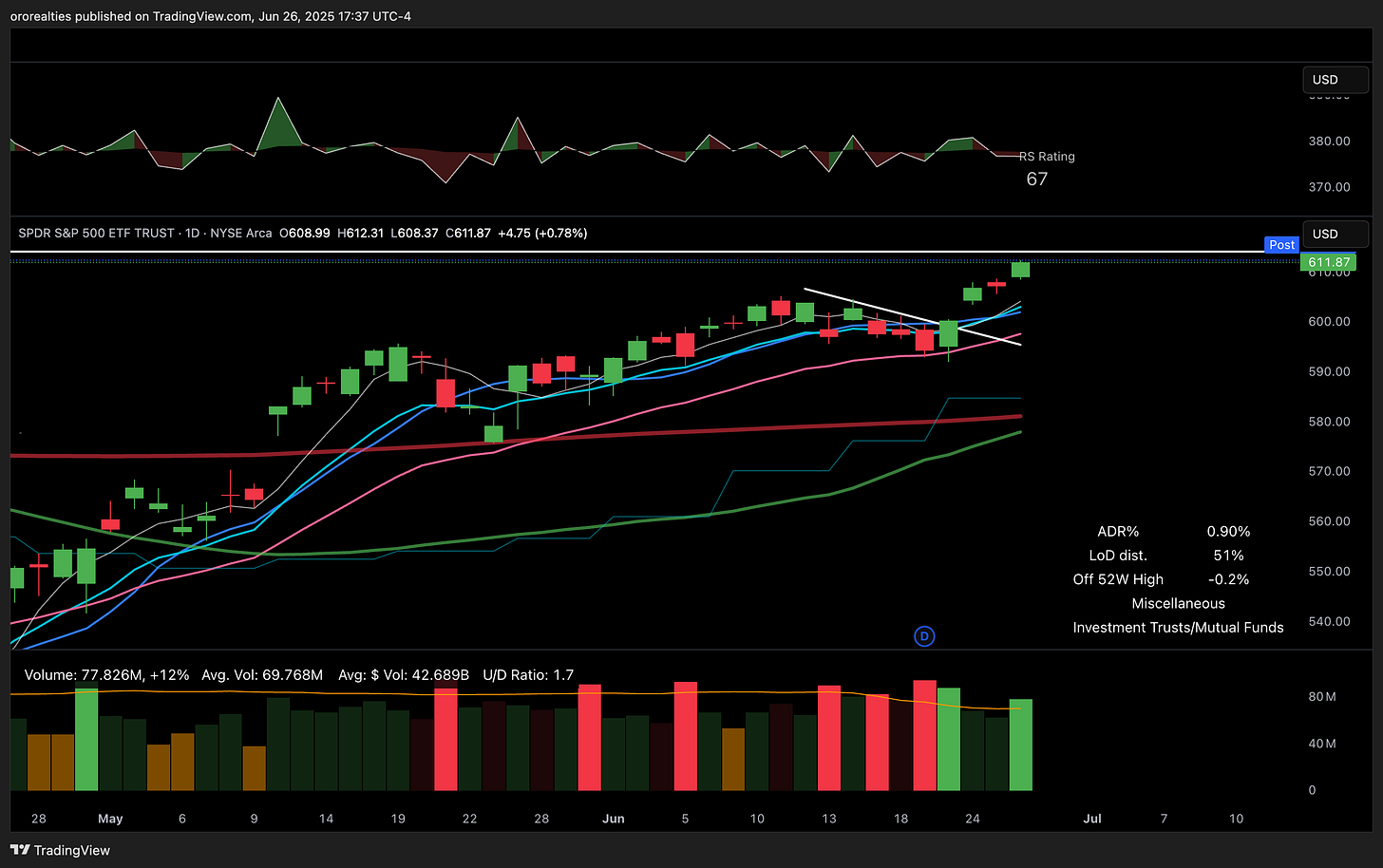

SPY

SPY also pushed higher and is closing in on new all-time highs.

While we haven’t broken through just yet, we need to come in with a prepared and balanced mindset—knowing rejection is always possible at key levels.

We’re riding above rising moving averages, so I’ll continue operating on the thesis that pullbacks and digestion are buyable—so long as they occur above trend.

IWM

IWM held up well today, currently tucked between the 10 EMA and the 200-day moving average resistance above.

We have a very clear pivot that needs to be cleared—this is the line in the sand for small caps. A breakout above this range could ignite a meaningful move.

We’re still above the rising 10 and 21 EMA, so the setup remains constructive.

ARKK

Today, ARKK responded well to yesterday’s engulfing candle and looks ready to push away from the major cup resistance pivot.

This ETF is firmly in gear, with several top holdings continuing to act as current market leaders.

It’s a clear contrast to previous periods when the ETF was accumulating laggards as Cathie Wood averaged down heavily.

Gold

Gold continues to trade tightly along its rising 50-day moving average.

We’re seeing it pinned between the 50 and 21 EMA, and I’ll be watching to see which direction the break occurs.

There’s excellent risk/reward on trying a position here, given the asymmetry.

Bitcoin (long)

Bitcoin was quiet today, taking a breather and likely allowing the 10 EMA to catch up from below.

It’s back above the moving averages and inside the congestion zone, so we’ll patiently wait to see whether we get a breakout, more chop, or another failed move.

For now, price remains above our cost basis—and that’s what matters.

USD

We’ve been discussing dollar weakness, and today we saw a decisive breakdown through the range lows. Very hard to be bullish on the dollar here—perhaps we’ll get a reversal extension?

TNX

The 10-year yield continues to slide lower and is now trading firmly below its 200-day moving average.

This breakdown from the May highs has clearly helped the market move more freely.

Our market indicator

Flips to a GREEN signal (disregard colours)

Quallmaggie indicator

Today’s powerful breakaway move confirms and reinforces our green risk-on signal.

As long as the index and leaders continue riding above their moving averages, there’s little reason to be overly cautious.

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, portfolio, the full video version of my newsletter, & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.