Bitcoin breaks out, but indexes stall at the 200-day: Here's what to do next!

Huge move for our Bitcoin position, earnings move keep impressing

Yesterday’s hammer candle lead to nice upside follow-through, as indexes tested the critical 200-day moving average resistance.

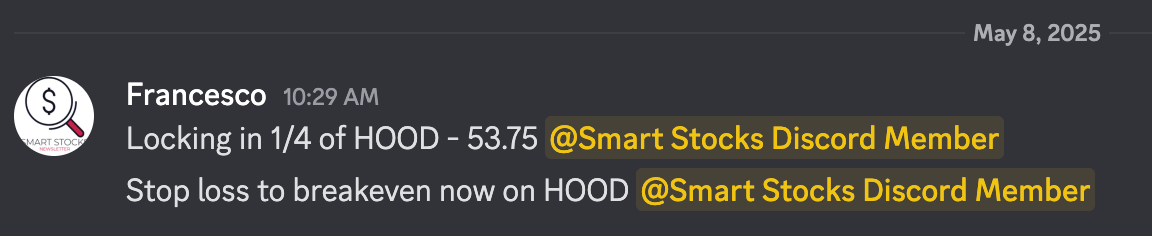

Stock action was impressive, with our portfolio gaining nicely, led by big moves in Bitcoin and HOOD. We used the strength in HOOD to trim 1/4 of the position.

All trades are posted in the Trading room in real-time

Leading names continue to perform, building momentum in our watchlist.

A decisive break above the 200-day moving average could fuel the next leg of this rally, and that is the key detail I am looking for.

We have tonnes of great earnings reactions that may provide quality setups— I’ll be building a brand new watchlist this weekend.

IF we can get above resistance, it could be game-on.

Let’s dive in to setups to watch for tomorrow, check up on our market indicators & more!

Check out my interview with Christian Flanders here, released earlier this week! Lots of great insights from Christian on the trading year so far.

QQQ

QQQ gapped up strongly off yesterday’s hammer candle, firmly holding support.

The big question now: will we break through the 200-day moving average, or do we need more consolidation below it?

Today’s attempt fell short of a clean breakout. I’m fine with a few days of rest here, though the market may keep pushing.

Secondary indicators are heating up, but charts still signal potential for higher prices.

SPY

SPY broke out of its trendline setup and is now testing the 200-day moving average.

The setup looks solid, and we’re awaiting confirmation of a breakout.

Resistance at March’s high of 576.41 looms, so there are hurdles ahead. No rush—we react to price action as always.

IWM

IWM broke out of its flag pattern and is now decisively above the 50-day moving average.

Small caps are joining the rally, a constructive sign for the broader market, with a clear path to the 200-day moving average.

Gold

Gold slid through the 10 EMA on heavy volume today. Its weakness has historically favoured equities, and I’d welcome a breakdown here.

Rising volatility and churn suggest money is flowing out of this defensive asset—a bullish signal.

Bitcoin (long)

Bitcoin, our top focus for weeks and largest position, broke through key resistance today, opening the door to test all-time highs.

I’ve been very bullish, and price action is now confirming this view. With cushion in both entries, we’re well-positioned and will let this trade play out patiently.

USD

The dollar surged through the 21 EMA for the first time since March. Let’s see if this signals a trend reversal.

TNX

The 10-year yield bounced off moving average support, showing no immediate signs of rolling over.

Our market indicator

Remains on YELLOW signal.

Net lows poked out once again, but the reading was minimal. We want to see a big push to green if the market is to break out above the 200-day.

Qullamaggie indicator

Our Qullamaggie indicator remains RISK ON.

Our risk-on signal holds strong, displaying the consistently better action in the market. Index strength and leadership reflect the power of trading with an uptrend.

SKFD

We are staying very elevated here and this move is getting extended in the short-term. Caution warranted until we get a bit more of a digestion.

NCFD

A solid push higher today, but we still have room to work before we get a very extended signal.

NASI

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.