🤔Big Moves, Bigger Questions: CPI, Gaps, and What’s Next

A thinning market, unable to hold gains today. All eyes on PPI tomorrow.

Key takeaway: If something feels off about taking a trade, it’s okay to say ‘I’m going to chill here’. Never an excuse to force a trade.

It’s time to be extremely flexible here.

Sure, Semis were good, so was MP, OUST, ASTS… but— not much else!

This morning’s CPI report triggered a sharply divided market reaction—with QQQ finishing green (just), while IWM came under heavy pressure.

Those of you who have followed me for a while know my stance: gap-ups are some of the worst days to add risk.

They often become liquidity traps, leading to increased volatility around key pivots—and today was no different. We saw early strength fade, with weakness creeping in after the gap move.

Could the rise in inflation delay the timeline for rate cuts? That’s the big question.

But one thing is certain—more weakness could easily be on the way, with the PPI report hitting premarket tomorrow.

The market dished out another mixed bag of action.

Semiconductors popped on the back of NVDA-related strength, while other areas remained choppy. Last week’s theme still holds true:

“Yesterday’s hero is today’s villain.”

Stock selection and timing remain absolutely critical here—just ask those chasing Bitcoin, now watching price pull back sharply.

In the Trading Room, once again we remained patient and disciplined today.

Gap ups are dangerous, and no surprise we saw largely ugly action in the indexes and watchlist was enough to make us sit on our hands— even though Semis and a few individual stocks were strong.

Tonight, I’ll look at:

The red flags I saw in the market today

What to watch out for, from here!

Positives of today

Actionable trades ideas if we see strength

Leading stocks and themes

Market Internals / breadth

Situational awareness points to caution

Index analysis, dollar, 10-year yield

Video breakdown of everything

Let’s dive in!

* Members, don’t forget to watch the video I sent our today about my screening process

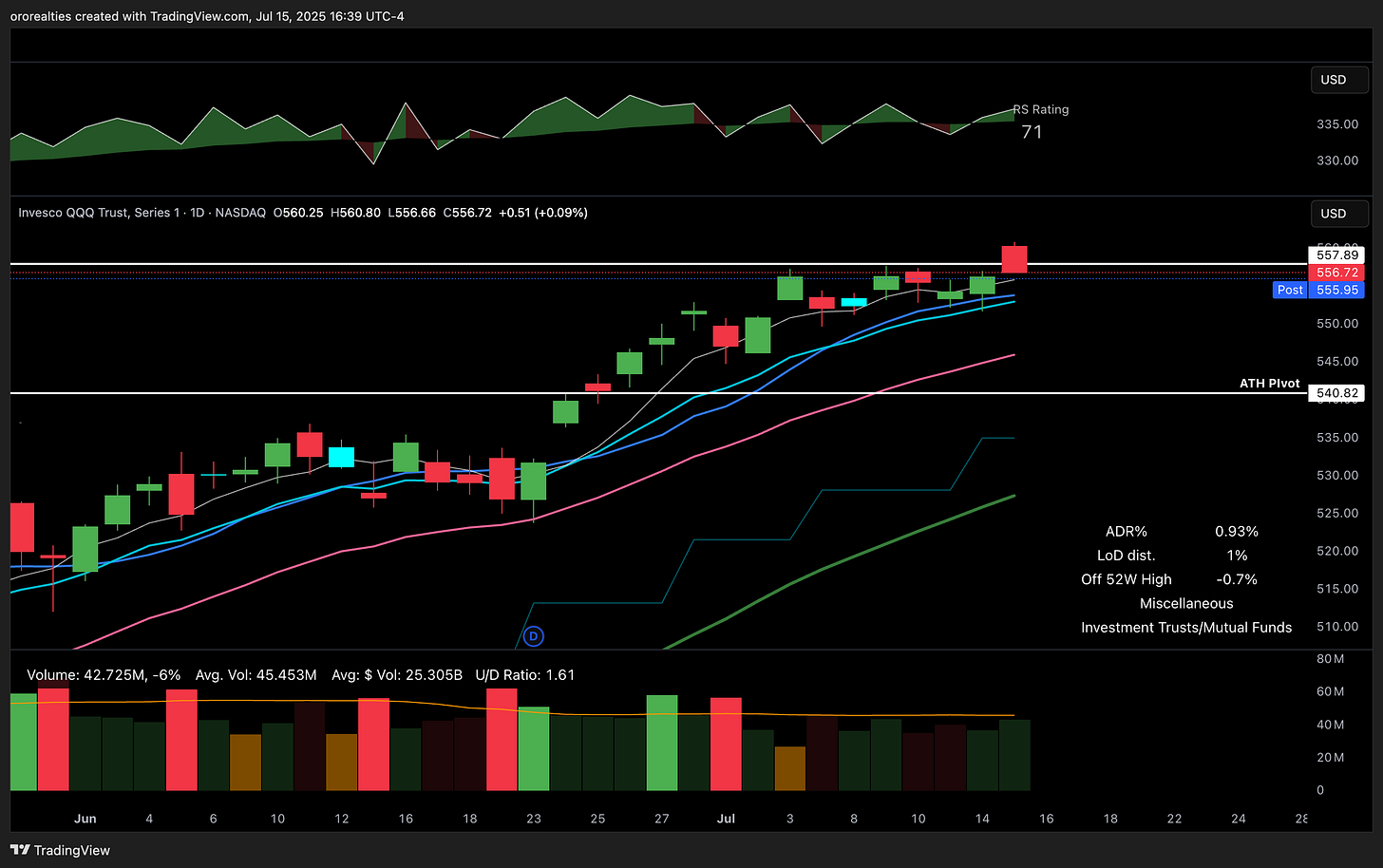

QQQ

QQQ is a prime example of how challenging gap-ups can be, as we saw it open strong and sell down for most of the day.

Now we wait to see what happens with the gap—will it get filled, or could today’s low hold, and mark the beginning of a trend we can anchor our stops to?

Perhaps the market got a bit too excited by the semiconductor news.

QQQ did hit a new all-time high today, but not a good close. Now the 5SMA needs to hold.

SPY

SPY also made a new all-time high before pulling back into the prior week-and-a-half’s range.

If you were too aggressive at the open, you likely ran into trouble—another reason I always recommend sitting on hands during gap-up days, for the most part.

We got some clear feedback today— that the index isn’t ready to break out yet.

IWM

IWM has been fantastic, but today it didn’t respond well to the CPI print, selling off all day after a gap-up.

Today’s bearish engulfing candle suggests some short-term rest may be due.

After a strong surge off the 21 EMA, it wouldn’t be unhealthy to retest it.

Let’s take it day by day—the recent price and volume action has been excellent, so let’s give IWM the benefit of the doubt here.

ARKK

ARKK had a pullback day but remains above the rising 5 SMA, so nothing to much to worry about here— for now.

It’s important not to overreact to daily price action—if it respects the trend and the moving averages, there’s no reason to stress to much. Just follow the plan.

Gold

Gold pulled back and was unable to challenge the pivot mentioned in yesterday’s newsletter.

It’s now back under pressure and sitting right at the 50-day moving average.

I’ll continue to observe patiently—we need to see price tighten up before identifying any actionable setup.

Bitcoin (long)

Yesterday, I stressed the importance of not chasing breakouts, and anyone late to the party on Bitcoin likely got shaken out.

We’re seeing profit-taking after an explosive move.

The key now is to watch for price to hold above the 10 EMA, which is my current expectation.

Interestingly, the 21 EMA has now risen to meet the former all-time high pivot—extra support may be building there if a retest occurs.

We saw news strike:

HOUSE REPUBLICANS have failed to clear a procedural motion that would allow consideration of a pair of crypto bills and the defence spending bill. 196-222 Huge blow to crypto’s sway in dc.

Another vote will occur at 5pm.

Long from 106,618

USD

The dollar had a strong day and is now approaching the declining 50-day moving average, which could provide resistance.

If it breaks through, the dollar has plenty of room to run after a tough year. Let’s see what happens.

TNX

The 10-year yield broke out decisively today and looks to be building momentum.

We saw small caps come under pressure—is this a signal of a short-term trend shift? Rising yields and weak small caps is something to watch.

Our market indicator

Flips to a YELLOW signal.

We’ve seen a few cracks appear of late, and it was once again the case today. Time to be a little cautious here.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.