Are markets ready for an explosive breakout?

Indexes primed for BIG breakouts, as stocks look ready to rip on ceasefire news

Key takeaway: Trade and trust price, not news

I am very optimistic here and feeling ready to hit the gas tomorrow, as indexes look ready as do MANY stocks.

Surprisingly, our setups focus list is loaded tonight—if the overnight move holds.

There's a famous trading adage by Brian Shannon: "Only price pays."

Not news or headlines, just price. Moments earlier, a cease fire was announced between Israel and Iran— and markets are FIRING!

This serves as yet another stark reminder —focus on price action, not headlines.

Stocks shook off intraday weakness from an Iranian retaliation to power ahead, looking primed for a major technical breakout.

Volatility shook the tree again today, but as always the close matters most, and it proved impressively strong.

Tonight, I’ll look at:

Bullish index setups I’m stalking

A LONG list of setups for tomorrow

How I handled CRWV’s volatility today

My ‘line in the sand’ for this market

Market Breadth, Internals

Hot themes, Portfolio review

Let’s dive in!

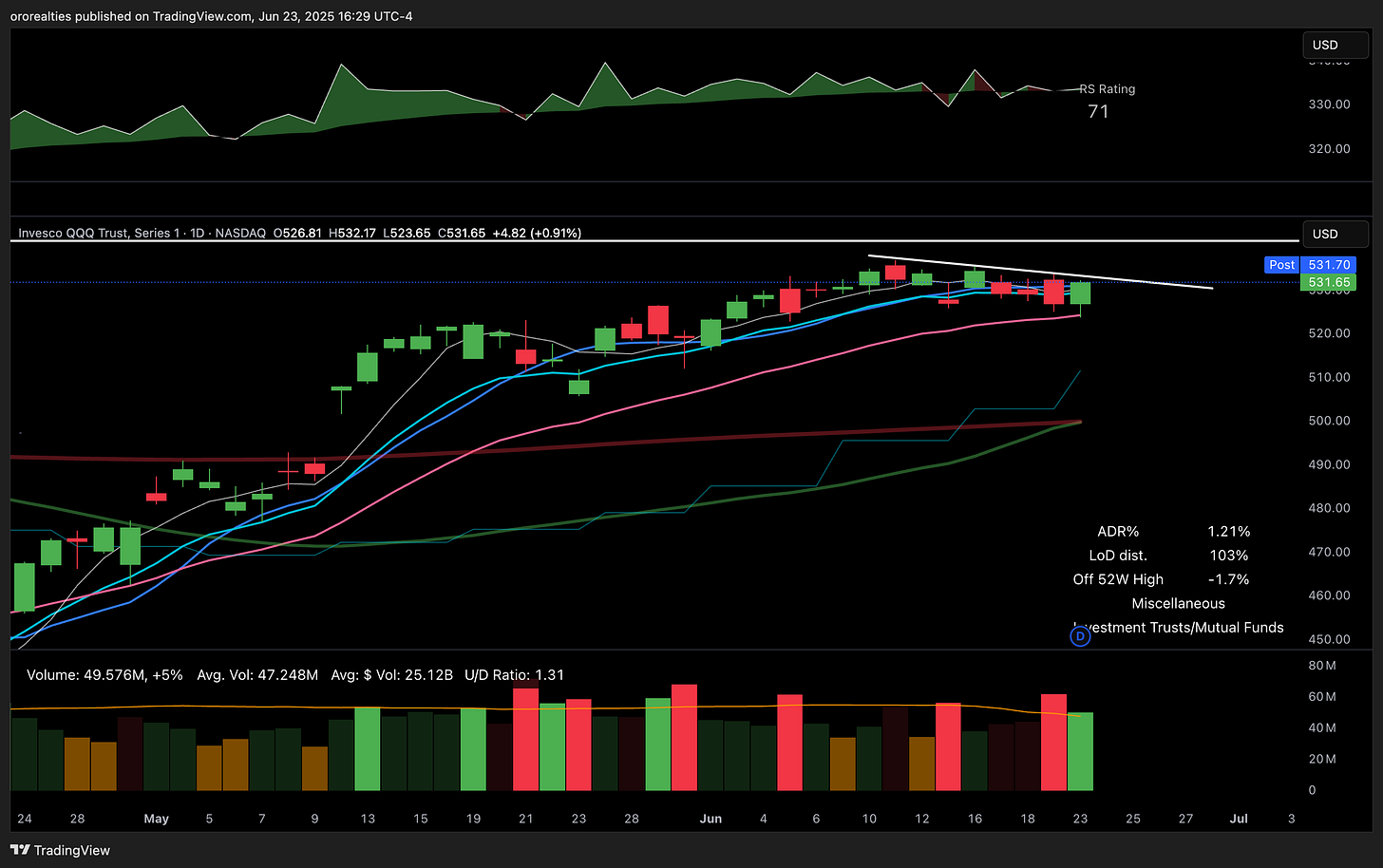

QQQ

Over the weekend, we noted QQQ sitting at a critical support level.

Despite a significant shakeout, bulls held firm, defending the line. Despite ALL negative headlines.

We’re now poised for a potential descending trendline breakout tomorrow.

On the bearish side, very simply, a breakdown below the moving average could trigger a sell signal, emphasizing the need for major flexibility.

A strong opinion must be loosely held here.

SPY

SPY executed a sharp shakeout below the 21-day EMA before rebounding to find support at the moving average.

Price is now trying to clear the descending trendline and the 10-day EMA/SMA above, and we’ve got a nice gap up in the works after hours.

These levels must be breached for a breakout higher.

Can the market overcome the accumulating distribution days and break away from this multi-week consolidation?

I’m bearish below the 21-day EMA and bullish above it.

IWM

IWM endured a powerful shakeout beneath its recent range and the 21-day EMA, then sprang higher, closing back above support.

Shakeouts are unpleasant but common, often prompting traders to exit before an upward move.

Resistance from the 10-day SMA has emerged recently, so let’s see if this reclaim holds.

ARKK

ARKK sustained its strong run with another solid day, riding the rising 5-day SMA—a clear sign of strength.

Volume surged today, making this ETF a top focus for any pullback. This is where novices often chase into supply and get stopped out quickly— patience!

Gold

Gold continues consolidating along the rising 21-day EMA, showing muted price action despite mixed news headlines.

A push above $3,424 could signal the start of an upward move.

Bitcoin (long)

Bitcoin experienced a major shakeout over the weekend, briefly dipping below the 10-week moving average before a monster recovery.

On the weekly chart, a bull flag and orderly low-volume pullback are evident.

After hours news sent Bitcoin pushing back above the moving averages— on close watch.

USD

The dollar attempted a breakout toward the 10-week and 50-day moving average area but faced a stiff rejection, selling off lower.

Price is now back below the moving averages, potentially setting up a test of the lows.

TNX

The 10-year yield broke below its range and is now testing the 200-day moving average. Support held here last time, so let’s see if it repeats.

Our market indicator

Remains on a YELLOW signal.

We are holding up well above the moving averages. Let’s see if tomorrow we can push above the trendline and break out.

Quallmaggie indicator

Our Qullamaggie indicator flips quickly back to RISK ON.

After three days of chop and weakness, we flipped to a green buy signal.

The chart looks well-positioned for a breakout higher, with staying above the moving averages being critical.

Stay in sync with the market. Get daily market and hot theme review, actionable trade ideas, portfolio, the full video version of my newsletter, & more straight to your inbox.

Keep reading with a 7-day free trial

Subscribe to The Smart Stocks Newsletter to keep reading this post and get 7 days of free access to the full post archives.